(This opinion column first appeared in the October print edition of the Hendersonian.)

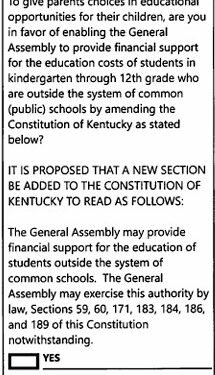

Amendment 2 is intentionally written to be vague and deceptive. It is positioned in the second position to trick us into assumptions that would entice us to vote positively for it without being fully informed as to its content (like assuming it is about the right to bear arms). The attorney general has inserted strict restrictions denying all public school employees from engaging in any persuasive activities regarding this proposed amendment even though it directly affects their lives, their families, their communities and their personal livelihood. These people are the most informed and likely intelligent perspectives on this proposed amendment. Thus, they are the best source of information on this issue, but they are strictly ordered to only respond to questions and be only factual and never persuasive. Why would any of these deceptions and restrictions be necessary if this were a quality amendment?

The public should read carefully and educate itself before voting on Amendment 2. We should all be suspicious and investigate why these conditions are in place. It’s also critical to note that the Kentucky State Constitution notes in many different sections that ALL public funds (that’s taxes) will only be spent for the common school (that’s public schools). My retired teacher sources—Kentucky Council for Better Education, Kentucky School Board Association and Kentucky Retired Teachers Association—say that it is delineated in seven different places. So, I went to the Kentucky General Assembly website and read the constitution for myself.

I found specific references in:

• Section 59—Prohibits the legislature from passing laws targeting specific areas of state

• Section 60—Prohibits legislature from indirect enactment of laws targeting areas of state

• Section 171—Requires that taxes can only be collected for public purposes

• Section 183—Legislature is responsible for establishing efficient system of public schools

• Section 184—Common school fund, prohibits taxation for funding of nonpublic schools

• Section 186—Education funding exclusively to be used to maintain state’s public schools

• Section 189—Prohibits public education funds from being used for church, sectarian or denominational schools.

Clearly our forefathers did not want us to use public funds for anything other than public education. But today, in 2024, our legislators (some of them anyway) want us to approve a vague amendment that opens the door to all forms of expenditures to be taken away from public schools and diverted to targeted private schools (a majority of which are located in the highest populated areas of Lexington, Louisville and northern Kentucky) as well as homeschool programming of all types and any other system of education that may or may not be of comparable quality that is created or defined in the future. This blows that door wide open.

To be honest, there is never enough funding for public education. We want all kids to have enriched environments to learn in, generous resources, field trips to everywhere exciting and dynamic educators who feel valued, empowered and adequately compensated. That will almost always cost more money than the public coffers can cough up. But this amendment has no additional funding attached, so it would steal these already limited and valuable dollars and relocate them to private, for-profit and unregulated institutions. These places do not have to answer to any of the state or federal testing accountability regulations that largely drive public schools. They choose who to accept and who gets to stay. It does not take much for private schools to send a child out of their institution for any reason, even after they have taken money on behalf of that child. There is no system for refunds or transfers of money when students shift in and out of schools. Statistically, these institutions mostly choose not to serve any students who need special interventions or services for academics, language barriers, behavior or poverty in early learning environments. It is also proven in states who have enacted similar legislation prior to this—Arizona and Ohio are just two—that while advocates for the legislation tout opening access to poorer populations to private education as a target for this, the reality is the private schools prefer to select students, and thus have raised their tuition in those states beyond the state allotted funding so that they could still restrict access to only those families who could pay above and beyond the state allotted funding. So, children in poverty were not served by this legislation, and the private institutions just took in more funds while keeping their enrollment elite.

Here in Henderson, thankfully, this is not the burning issue it is in other areas of Kentucky and other states. At the most recent retired teachers meeting here, local educators learned about this amendment and debated it extensively. Overwhelmingly, these retired teachers clarified their appreciation for our local private institution and the good work it does. Numerous retired teachers spoke out saying they have no criticism for the local private, church-affiliated school. But—as a whole—this isn’t true in all communities and there are even individuals across the state who would take large amounts of money to pay for homeschool programming that they often do not follow through on completing. That is just wasted money. While some programs are quite strong and viable, it is a proven factor that these rely on the commitment of parents and children to work very hard independently for extended time to hold up to what public education offers. Human nature is rarely inclined to measure up to this in the long term. So, for every successful example of private school or home school, there are sadly extensive stories of those who did not use their resources wisely and have no system for accountability in them. On the other hand, public schools always must report their school scores and statistics to duly elected school boards, the media and state and federal education accounting systems. It just isn’t a level playing field for serving the population or for accountability.

I am a retired educator, a mom of adults educated in our private and public schools, a grandmother of children in public school, a passionate citizen of our community and state, and the current president of the local retired teachers association. I am completely flummoxed that any person in our state would think this does not smell fishy and suspect. The logic seems to be obvious and goes far beyond the points I have addressed here. I chose to only speak on elements I could prove and support factually rather than the suspicions and conspiracy whispers that are in the ether. But clearly some agenda is at work here, and it is NOT in the best interests of our children, our schools or our society as a whole. Please educate yourself and read all you can before November 5. Then vote “No” to Amendment 2.

Doneta Williams is a retired English teacher and assistant principal of Henderson County High School. She is married to Brian Williams with two grown children, and three grandchildren. She is president of the Henderson County Retired Teachers Association.