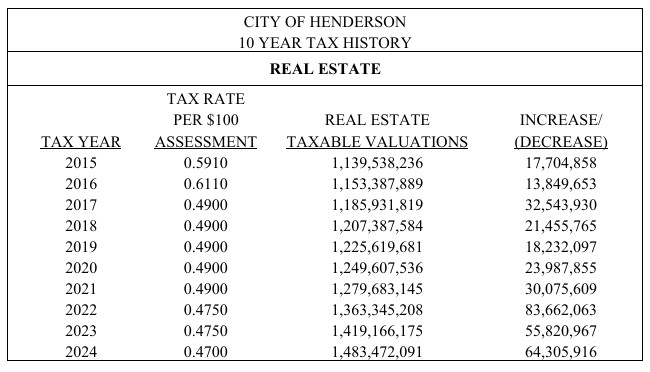

Rates have been on a decline since 2016

Though the Henderson City Commission preliminarily approved tax rate decreases Tuesday for both real and personal property, the city stands to receive more money from both streams of tax revenue.

The preliminarily approved rate for real estate is 0.470 (47 cents) per $100 valuation. That’s down from last year’s 0.475 (47.5 cents) per $100 valuation.

The 2023 real property rate of 0.475 brought in $6.74 million, while the 2024 tax at 0.470 is projected to yield $6.97 million, an increase of $231,279, according to a document prepared by Finance Director Chelsea Mills.

The projected bump comes because real estate assessments have increased $64.3 million over last year, according to the document. In 2023, real estate assessments in the city were set at $1.419 billion; in 2024, real estate assessments increased to $1.483 billion.

Though tax rates will decrease, Mills said it’s “case-by-case” if an individual property owner will pay less.

Property Valuation Administrator Andrew Powell said his office assesses ¼ of the county each year, so those homeowners whose property hasn’t seen an increase should pay a bit less.

According to Mills, an owner of a $100,000-assessed home can expect to pay $470 in tax; a $200,000-assessed home will have a $940 tax; and a $300,000 home will be taxed at $1,410.

The 2024 real property assessments represent a 4.5% increase over 2023, according to Mills’ document.

Powell said his office’s assessments are based on the fair cash value and valuations are “market driven.”

“The market is just really, really up,” he said.

Though some of the increased values can be attributed to low interest rates from several years ago, he said the demand locally remained high even as interest rates increased the past couple years.

He said there are just not many homes for sale, which increases prices. He said that additional homes coming to Henderson via the Bentley Point subdivision currently being constructed behind Walmart could alleviate inventory stress and level out home values.

For personal property, the preliminarily approved rate is 0.606 (60.6 cents) per $100 of assessed value, down from Fiscal Year 2023 rate of 0.645 (64.5 cents) per $100 of valuated property, according to Mills.

The 2024 rate is expected to bring in $1.155 million, up from last year’s $1.18 million, or an increase of $36,719, according to Mills.

In 2016, the real property rate stood at 0.611 per $100 of assessed value. In 2017, the rate dropped to 0.49 per $100 of assessed value, where it stood till 2022, when it was decreased to 0.475. Personal property rates have decreased in a similar manner. (See graphs below)

The deadline to pay taxes with a discount is Nov. 15. The deadline to pay without a penalty is Jan. 3.

The commission will hear a second reading and hold a final vote at a special called meeting on Tuesday.

In other news from Tuesday’s city commission meeting:

- The Henderson City Commission approved a purchase of 56 Taser 10 Bundle packages.

According to a city memo, the total purchase price for 56 Taser 10 bundle packages is $274,878 and will occur in five annual payments at $54,975.60. The memo said funds are available in the current budget for the purchase.

In a different memo from Henderson Police Chief Billy Bolin to City Manager Buzzy Newman, the chief said that the department’s current tasers are becoming “obsolete and unrepairable.”

- The city finance department was awarded the Government Finance Officers Association’s Distinguished Budget Presentation Award for its most recent budget. The finance department has won the award the past 16 years, Mills said.

Mills was hired late last year to replace longtime Finance Department Director Robert Gunter. She said she was happy for the department’s award and looking forward to more in the future.

- The Habitat for Humanity of Henderson was recognized with the Community Spotlight award for its work in bringing affordable housing to the city.